Most consumers and sales professionals alike may not understand the urgency of moving now before the interest rates do. However, use the example of rates increasing by merely one percentage point. I’ll illustrate why this is important.

Most consumers and sales professionals alike may not understand the urgency of moving now before the interest rates do. However, use the example of rates increasing by merely one percentage point. I’ll illustrate why this is important.

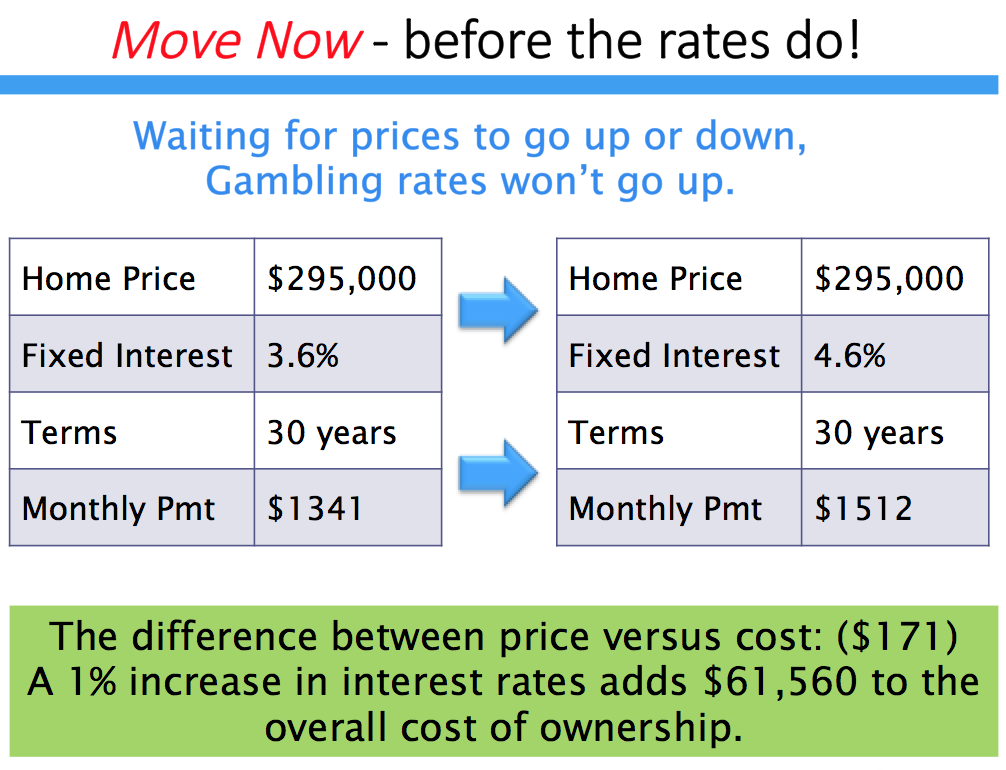

Suppose a home is priced at $295,000. Naturally, the customers we consult with and salespeople we educate represent homes across America that may have prices as little as $199,000 or up in the millions of dollars. But, we’ll take the median of $295,000, purely for example purposes. Now, keep in mind the difference between cost and price. The price of $295,000 is a one-time event, while the interest rate represents a 30 year on-going cost.

Please note the difference in payment (cost). A mere one-percent increase in interest rates seems small at only $171 per month. However, an increase in the monthly payment (cost) over 30 years is a whopping $61,560!

Using this example, you may want to memorize and internalize the following script (Sales Dialogue) and use it to convey the urgency to your potential customers “to move now before the rates do.”

Prospect: We need to think it over (or) sell our home (or) wait (stall) for whatever reason.

Superachiever: Miss Prospect, may I explain the benefit of moving now, rather than waiting?

Prospect: Yes.

Superachiever: The challenge with waiting involves several factors. First, if you are not aware, interest rates have been considerably rising. As a matter of fact, rising rates are an inevitability. With this in mind, consider how interest rates can affect the value of a brand new home.

When acquiring a home, you must always consider the relationship between cost and price. The price of the home is only $295,000 and is, of course, a one-time consideration and a fixed amount. However, cost is an on-going expense and can dramatically affect the final value of a home. A mere one-percent increase in interest rates represents an additional $171 per month or $61,560 over the entire term of a 30-year loan. When you analyze the situation, it’s as if you can say the price of a $295,000 home will now cost $356,560 if interest rates rise by merely another percentage point. Miss Prospect, my question to you is, “Do you think it’s possible that rates could continue to go up?”

Prospect: I suppose they could.

Superachiever: Then I suggest you consider moving now before the rates do. Does that make sense to you?

Prospect: Yes, when you put it that way, I suppose it makes perfect sense.

Superachiever: Let’s do this. We’ll work together and select the perfect home and place it on the ideal homesite, and simultaneously discuss the best financial program available to fit your unique needs.

With this information and selling strategy, you should be able to take advantage of any move the market and the economy make. Of course, the best information won’t benefit you unless you apply it. So take this information and if it applies to your selling situation, change your selling strategy before the interest rates do.

*Calculations do not include taxes and insurance

Myers Barnes is America’s favorite new home sales trainer, author, speaker and consultant. For more information, please visit www.myersbarnes.com.