Why are new home sales professionals struggling so much right now? I believe they’re looking at the housing market all wrong, and, therefore, missing a big opportunity. Use the art and science of rate buy-downs, for example. Are you using a financial strategy with your new home buyers now? If not, you need to keep reading.

Ups and downs…and ups

When the housing market shifted earlier this year, I saw a lot of new home sales professionals make their own shift—into a deer-in-the-headlights paralysis. After two solid years spent navigating a tsunami of eager homebuyers, the waters receded. Then, interest rates rose.

The salespeople who experienced the downturn of 2008 and the ensuing housing market shift have a clearer perspective on selling in tough times. However, there are many who are relative newcomers. For any of you who need help, I suggest you invest in learning more about the financial side of homebuying. With knowledge, you can manage the objection to rising interest rates and effectively answer, “Why should I buy a new home right now?”

I decided to get a pro to jump in and offer help here. Karen Gurley, Vice President at First Oklahoma Mortgage and a pro who is laser-focused on what’s happening in the world of finance.

Myers Barnes: Karen, what is the big misconception in homebuying right now?

Karen Gurley: We’re hearing so much nonsense that we’re going to have a crash. There’s not going to be a crash. We’re short on inventory. The press is putting out fear that the housing market is crashing. It’s not. We’re just not appreciating as much.

Here in Jenks, appreciation was 13.3% last year. It’s now 10%. Normal appreciation is about 4 to 5%, We’re not having short appraisals, so it’s not a pricing problem; it’s an affordability problem.

Myers: A lot of new home sales professionals are having a tough time with overcoming the objection to the rising interest rates. What can they do to move their prospects to purchase?

Karen Gurley: Apply strategy! You have to find out what’s important to that buyer. Is it monthly payment or funds to close?

Myers: That sounds simple, but those who don’t have a strategy don’t know where to start.

Karen: Start with education. Work with a lender who works with you and your buyer.

When things started to change in January, I was going through everyone I had prequalified in building and buying with agents. “This is what has changed. This is what your payment is going to be.” I give them price points and let them know how much they’ll need to bring to closing. By keeping in contact, letting them know their numbers, and seeing those numbers in front of them, it makes more sense than just telling them. This knowledge dictates their spending habits, which is really helpful when you’re getting ready to buy a house.

Myers: In sales, 89% of believability is processed through your eyes. Visuals have impact, not what they hear or touch. They might get it, but do they BELIEVE it? Showing them is believing.

Karen: There are so many different options for lending and lenders should show you that! Most lenders will quote an interest rate and email a fee sheet.

As a Home Loan Strategist, I ask questions that most people have never been asked and then I custom tailor a cost analysis with multiple options based on their short- and long-term financial goals as well as their payment, equity, and cash flow objectives. 44% of Americans regret their mortgage decisions within 2 to 3 years of closing. They were put in the wrong program.

I give buyers what they ask for and then offer other options that I think better reflect their needs. But it has to start with discovering what’s most important to the buyers. That’s also how you build trust.

Myers: New home sales professionals need to be better versed in financing now. When they are, there are options that could take the “maybe” to a “yes!”. Buy-downs are a great way to move the needle. You can preserve the value of the home itself by not handing over a discount on the price.

Karen: Absolutely. A buy-down is the same as taking money off the price, but it can be a better option. You’re actually buying the difference in the par interest rate. This way, builders help buyers afford those homes that they qualified for 6 months or a year ago.

Myers: How would a salesperson approach the buyer with a rate buy-down?

Karen: When they ask for a discount on the price, say, “A discount won’t help you in the long run. Let’s stick with the $450,000 price BUT I’ll give you $10,000 in a buy-down. It will save you on the monthly payment and interest over time.”

You need to demonstrate long-term savings. Explain how much this loan is costing the buyer over time with an up-front discount versus a rate buy-down.

Myers: And it’s not just the buyer who benefits. The builder does, too.

Karen: With a buy-down, the builder maintains the home’s value and buys the difference in the rate. It hurts more in the long run if you’re bringing in lower prices on your appraisals. Builders automatically think, “Drop the price $10,000.” You will come out so much better by adjusting with a rate buy-down.

Image: Karen Gurley, First Oklahoma Mortgage*

Image: Karen Gurley, First Oklahoma Mortgage*

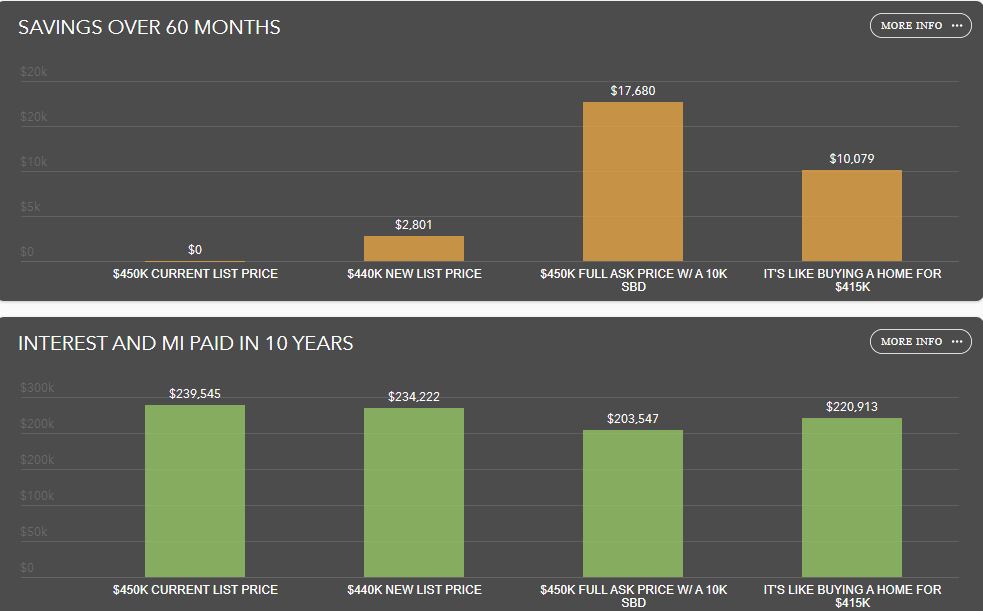

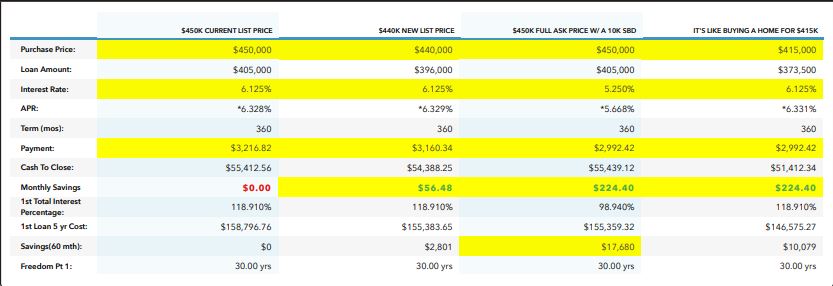

Myers: What does this actually look like in dollars and cents?

Karen: Let’s say the buyer has chosen a house with a $450,000 purchase price. The buyer is putting 10% down, so the loan amount is $405,000. At 6.125% (6.328% APR), the monthly payment on a 30-year fixed rate loan is $3,216.82.

If the builder discounts the purchase price by $10,000, to $440,000 and the buyer puts down 10%, the loan amount is $396,000. With that reduced price, the monthly payment is $3,160.34, a savings of $56.48 per month.

Now, look at the rate buy-down numbers. The buyer agrees to the $450,000 purchase price and puts 10% down, so the loan amount is $405,000. HOWEVER, the builder gives a $10,000 credit to buy down the rate to 5.25% (5.668% APR). That reduces the monthly payment to $2,992,42, a savings of $224.40 per month and $17,680 over the first 5 years of the loan.

With the rate buy-down, the numbers are comparable to buying that $450,000 home for $415,000!

Image: Karen Gurley, First Oklahoma Mortgage*

Image: Karen Gurley, First Oklahoma Mortgage*

Myers: The buy-down is a great solution. Now we just have to get the new home sales professionals to understand how it works and share it with their buyers.

Karen: This strategy resulted from the market shift. We closed 2 deals last week by offering the rate buy-down, because it works!

A lot of people think I’m in the business of doing mortgage loans. I don’t look at it that way. I’m more than just a mortgage banker, I’m a Home Loan Advisor. I help people obtain perhaps the largest debt in their life. I believe I have a professional responsibility to help them manage it. A lender needs to stay on top with the buyer, making sure they make the right choices.

Myers: Solutions are out there. Finding and applying them is not just the job of the salespeople. It starts with leadership. No coaching or teaching filters up from the bottom. It’s just not possible to filter up.

Are you leading your new home sales teams to achieve success in this challenging market? Let me know what’s working well in your sales training and sales leadership.