We had more than two remarkable years of irresistibly low interest rates. Then reality resumed. How are you discussing interest rates with your homebuyers right now? Are you providing them with the information they need to realize that buying a new home makes sense?

We had more than two remarkable years of irresistibly low interest rates. Then reality resumed. How are you discussing interest rates with your homebuyers right now? Are you providing them with the information they need to realize that buying a new home makes sense?

Let’s face it. It was easy when the interest rates dropped as low as 2.0%. Who wouldn’t want what amounted to free money? People were literally lining up to buy homes. Some were making this massive commitment sight unseen.

Now that selling a new home is more challenging, I’m seeing panic on the faces of new home sales professionals who haven’t experienced rates above 5%. So, if you’re committed to be in this business, then commit right now to learning how to address the objection to rising interest rates.

Provide perspective

Some of your prospective buyers are new to homebuying. All they can see is the unprecedented low rates of 2020 and 2021.

If you look at the history of mortgage rates, going below 5% is an anomaly. Sitting at rates above that point is more the norm. But buyers and sellers can’t see past the recent period of pandemic-related economic shifts.

Show prospective homebuyers the path of mortgage rates over time. Give them the peace of mind that what we’re seeing shouldn’t create panic. We’re following an established pattern.

Explain what contributes to mortgage rates: inflation rate, regional and local home prices, and the general economic climate. [NOTE: If you’re truly committed to understanding what causes inflation rates to rise, you get bonus points for reading this article by Stanford economist John Taylor.]

Then, remind your buyer that the home prices will continue to rise so buying now means they will begin the road to building equity sooner.

Present the rate buy-down solution

The interest rate buy-down solution is a great way to move past the impasse. How does a rate buy-down work?

With this scenario, the builder and/or lender pay the difference in the par interest rate of the home loan. There are different options, like buying down 1 point over the entire term of the loan or the 2-1 buy-down. With the 2-1 buy-down options, the builder (possibly in conjunction with the lender) buys down 2 points for the first year of the loan and then 1 point for the second year of the loan. The loan’s interest rate then reverts to the full rate for the remainder of the term. The 2-1 buy-down is a good choice for homebuyers who don’t plan to stay in this home for more than a few years.

The buyer is still financing the full selling price for the home—meaning you maintain the value of this home and community—but their monthly payment is lower. And in most cases, your buyer is looking at what they need to pay each month, so showing them the difference can be the deal-closer you need.

The buyer is concerned with being able to afford the home they want. Your job is to show them the clear path to purchase.

I recently spoke with Karen Gurley, Vice President at First Oklahoma Mortgage, about the current home financing situation and the rate buy-down. As with any selling proposition, you first need to understand the needs of your buyer and then provide them with up-to-date, honest information about how they can achieve their dream of homeownership.

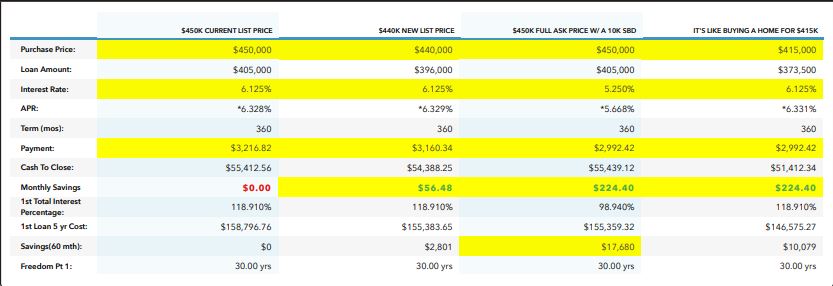

Look at the scenario below. Karen has outlined 3 options to purchase a $450,000 home: (1) at the full price; (2) with a discount off the price; and (3) using the rate buy-down.

With a $10,000 buy-down from the builder, the buyer pays $224.20 less per month on the mortgage and saves $17,680 on the interest over the term of the loan.

Can you sell THAT?

Benefits of the buy-down to the buyer

- Monthly payment is lower than if the sales price were lowered by the same amount.

- Interest paid over the loan’s term is significantly lower.

- The home’s value holds at its selling price, rather than a discounted price.

- If the rate drops during the term of the loan, the homeowner can refinance.

Benefits of the buy-down to the builder

- Maintain the value of the community.

- Avoid unhappy owners who see that newcomers are getting a discounted rate on their homes.

- Demonstrate flexibility without caving in on the price with unnecessary incentives.

- Close a deal that might otherwise walk away.

When is it a good time to buy a new home?

The answer is, when you’re ready.

Home prices will keep going up, so whatever your buyer pays today will be less than what they pay next year. Ask if they’re ready to start building equity or need to postpone that. They can gamble on the movement of interest rates or use the rate buy-down to manage their investment.

You can’t impact the rates, but you CAN control the conversation with your homebuyers.

If you need help crafting that conversation or other sales training targets, I’m here to help.